Sarasota News Events:

In 2025,

continues to face a significant affordability crisis, primarily driven by soaring housing and insurance costs. While the state’s overall cost of living index (99.5) remains slightly below the national average, the “affordability gap” for residents is among the widest in the country.

Housing and Rent

The Florida housing market remains a major source of financial strain for many residents:

- Ranking: Florida was ranked as the 49th least affordable state in 2025 by WalletHub.

- Home Prices: The median home price statewide reached $372,356 as of November 2025, about 3.7% above the national average. Some estimates for 2025 place the median sales price even higher, at approximately $415,000.

- Rental Squeeze: Median rent skyrocketed from $1,238 in 2019 to $1,719 in 2023, a 39% increase. For a one-bedroom home in 2025, the average rent is roughly $1,693.

- Cost Burden: Over 900,000 renter households are “cost burdened,” spending more than 40% of their income on rent.

Factors Driving High Costs

- Population In-Migration: Over 1 million households moved to Florida between 2019 and 2023, largely from high-income states like New York and California, increasing competition for limited housing.

- Insurance and Weather: Rising insurance premiums and the recurring risk of hurricanes have added significant ongoing costs to homeownership.

- Wage Gap: While the state minimum wage rose to $13.00/hour (as of September 2024), it remains insufficient for many to afford basic housing. The “survival wage” for a four-person family is estimated at nearly $35/hour.

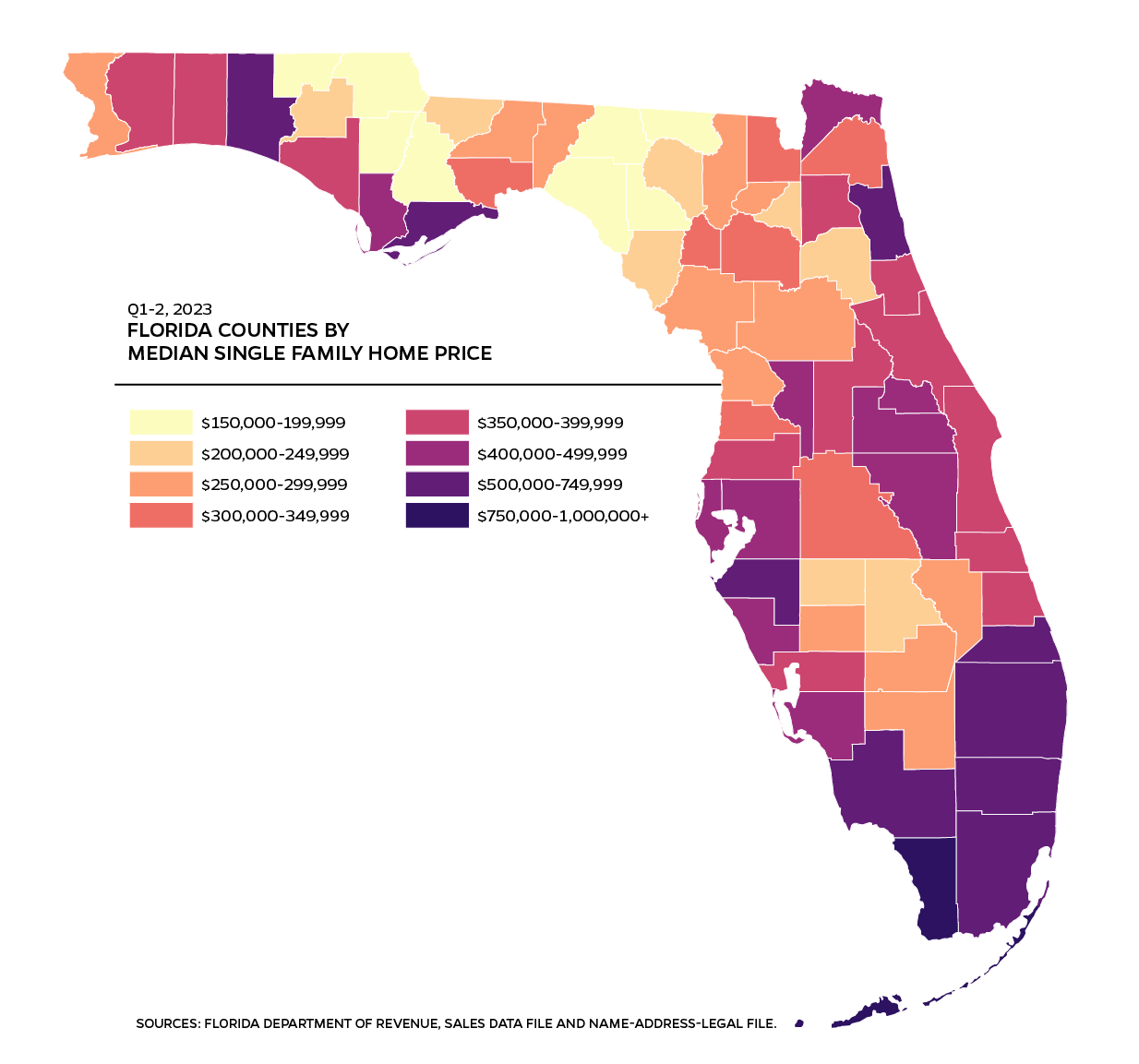

Regional Variations

Affordability varies significantly depending on location:

- Most Expensive: South Florida markets, including Naples, Miami, and Fort Lauderdale, remain the costliest.

- Relatively Affordable: More affordable options are typically found in central or inland areas such as Sebring, Homosassa Springs, and Ocala. Port St. Lucie is also cited as more affordable compared to other coastal regions.

Ongoing Policy Response

The state has implemented the Live Local Act (amended in 2024 and 2025) to increase housing supply by providing tax exemptions and streamlined approvals for developers who include affordable units. Despite these efforts, roughly 42% of Floridians reported in late 2025 that they have considered leaving the state due to rising costs.